Lublin Info Centre

Polish Investment Zone – a how-to

These are just some of the topics that were covered during the webinar “Polish Investment Zone – benefits for entrepreneurs in the tax and financial area” addressed to companies from both production and BSS/IT sectors regarding the development of their businesses that was held on May 13th.

The webinar was co-organised by the Investor Relations Office, the Agency of Industry Development and the Assistance Service Center in Lublin, while the guest speakers who shared their experience and expert knowledge in the subject of obtaining decisions on the support and benefits arising from it represented Lublin based companies Medisept and Lingaro.

The Polish Investment Zone (PSI) is one of the mechanisms to support new investments in Poland. A company planning to undertake a new investment may benefit from an income tax exemption of up to 70% of total investment outlays. Furthermore, support may be granted not only to investments from the industrial sector but also to those from the business services sector, including IT. Support for new investments may be granted to a company that is located anywhere in Poland.

Income tax exemption may be granted for either investment capital expenditure ( i.a. costs related to the rental or lease of land, buildings, land acquisition, the development or modernization of fixed assets (e.g. machines)) or two-year labor costs of newly hired employees.

In order to obtain the financial support, the company needs to meet quantitative and qualitative criteria:

Qualitative criteria – Lublin-based investments need to meet a total of 4 out of 10 qualitative criteria (at least one from each group that includes 5 criteria)

1. Sustainable economic development:

- Consistency of the investment with the current national development policy (priority sectors, e.g. IT),

- Adequate level of exports of products or services,

- Conducting R&D activities – 1% of costs incurred throughout the investment period will be spent on developing or purchasing R&D works,

- Creation of a modern business services center with a range extending beyond the territory of Poland (value of annual net income generated from the sale of services will be no less than PLN 100,000 and the centre will maintain the international range of services provided),

- Possession of a status of micro, small or medium – sized enterprise.

2. Sustainable social development:

- Creation of high-paid specialized jobs and offered stable employment (average salary must exceed the average gross salary in Poland, i.e. PLN 5,168.93 (as of November 2020)),

- Running a business with a low negative impact on the environment,

- Location of investments in medium-sized cities losing socio-economic functions or communes bordering on those cities or districts with an unemployment rate> 160% of the average,

- Predefined forms of cooperation with industry schools specialized in the given industry and supporting employees in constant development, acquiring education and professional qualifications (e.g. providing employees with extra trainings, language classes, establishing collaboration with universities),

- Taking actions in the area of the employee assistance programme (e.g. providing staff with private healthcare, insurance, holiday co-financing).

Quantitative criteria

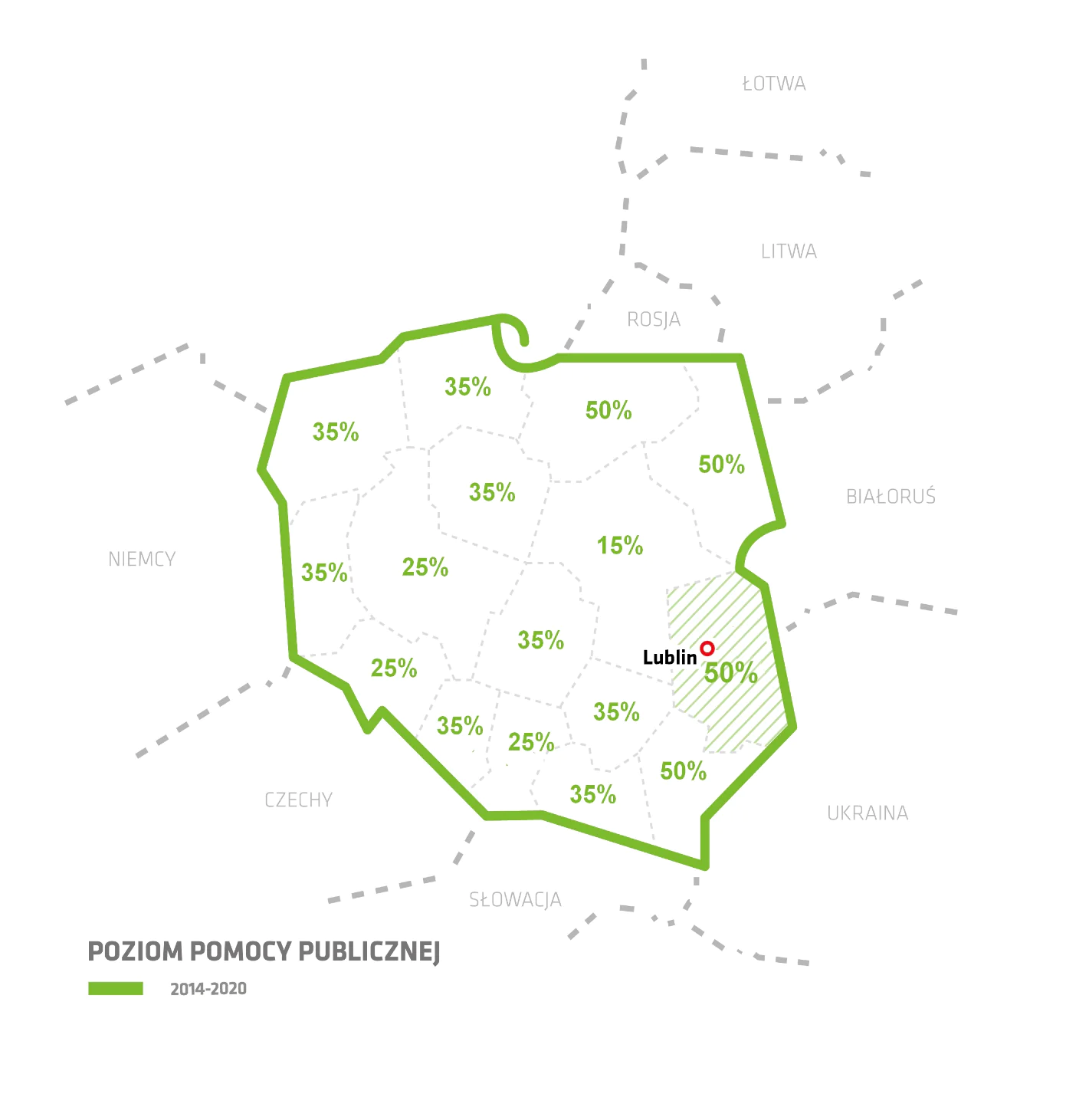

In Poland there are regional differences in the level of state aid allowed – Lublin benefits from the most preferential level of 50% for large enterprises, 60% for medium-sized enterprises and 70% for small and micro-sized enterprises, which means the level of allowed tax exemption in Lublin is highest in the country. Depending on the location in the country, there are different periods of tax exemption (between 10-15 years). Again, with the duration of 15 years Lublin benefits from the longest period of tax exemption.

If you missed the webinar or you are looking for more information on this topic, please contact us at [email protected]