Lublin Info Centre

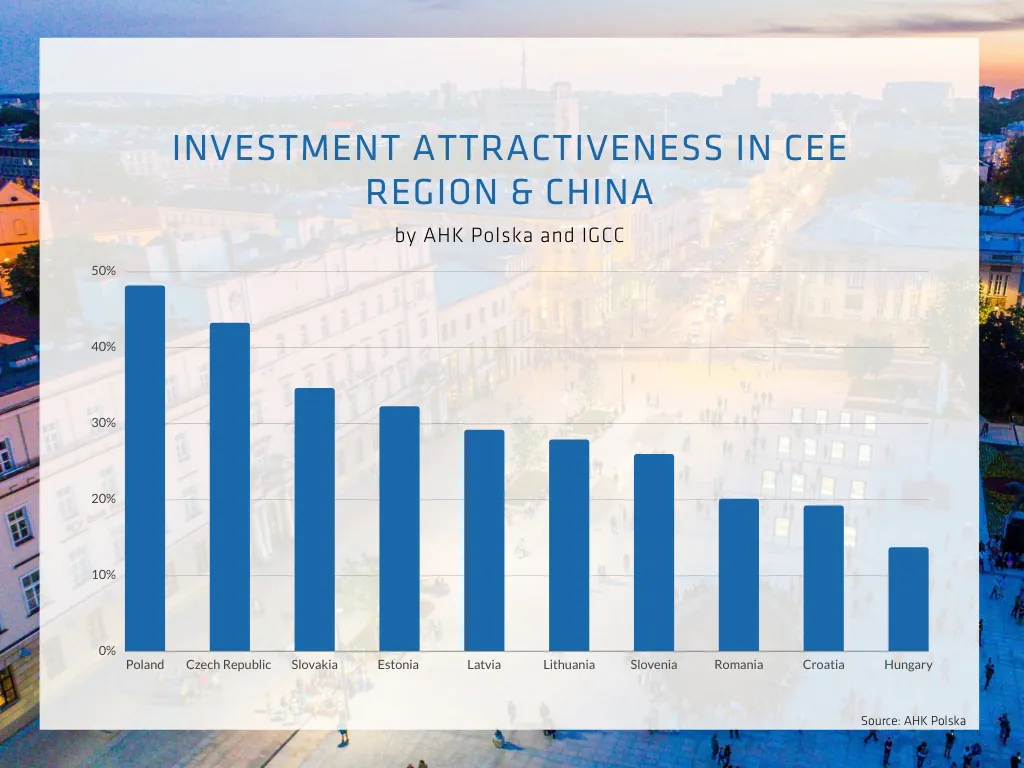

Poland leads the ranking of investment attractiveness

Moreover, the survey highlights that an overwhelming majority of 92.7% of the respondents would opt for Poland again as their preferred business location. This underscores the strong appeal of the country’s economic environment, business policies, and infrastructure that have helped in attracting and retaining businesses.

Despite facing extraordinary challenges, most companies have been able to maintain a stable position for their businesses by flexibly adapting their business models to the changing situation. Furthermore, they have used the new conditions to develop and improve their operational processes, as well as explore new expansion areas. This positive signal has placed Poland in the top ranking for the most popular investment locations in Europe, commented PhD Lars Gutheil, CEO of AHK Poland.

Poland’s membership in the European Union has been a major factor in making it an attractive place to do business. In fact, 99.1% of evaluations on this matter were positive. The quality and availability of local suppliers also ranked highly, with 95.5% of respondents expressing positive views, followed by the employees’ qualifications (93.2%)

However, surveyed investors also identified areas that pose challenges to doing business in Poland. These include issues related to legal security, the operation of public administration, and the flexibility of labour laws. In particular, they expressed concerns about the predictability of economic policy, with 63.6% of them expressing negative opinions. The tax system and tax administration also received negative evaluations from 48.2% of respondents. Furthermore, tax burdens and the country’s political and social stability were also areas of concern, with a significant percentage of respondents giving negative evaluations.

In terms of Poland’s economy, 66.4% of those polled had a positive outlook. However, this was a drop of almost 6 percentage points compared to the previous year. Over 33% of respondents rated the state of the economy as poor, which is the worst result since 2012. This negative evaluation can be attributed to the events of the last year, with nearly three-quarters of respondents reporting that their businesses were adversely affected by the energy crisis, rising energy prices, and inflation.

Entrepreneurs pointed more often to the deteriorating situation in their industry with a 9 percentage point increase in negative assessments compared to the previous year. Nevertheless, the majority (52.7%) still evaluated it positively. Regrettably, more than 36% of those questioned believe that the situation in their industry will deteriorate further in the coming year.

The results of this year’s survey clearly indicate a deterioration in the macroeconomic situation. However, despite the challenging business conditions, the situation of enterprises appears relatively stable, commented PhD. Gutheil.

According to the survey results, respondents evaluated the condition of their own companies positively, with most describing it as satisfactory. However, the number of those who considered their company’s condition as good decreased by 13.6 percentage points compared to the previous year. More than half of the surveyess reported that the condition of their company remained unchanged.

Entrepreneurs are cautiously optimistic about the future, with eight out of ten predicting growth or maintaining the same level of turnover. Prospects for exports are relatively stable, with almost two-thirds of questioned investors expecting revenues to remain the same, and one in five expecting an increase. While most companies plan to maintain their employment levels, one in four plans to hire additional staff. Employee salaries are also expected to rise, with the average salary expected to increase by 9.8%. Additionally, one in four companies plan to increase investment spending, but a similar percentage of firms plan to reduce these expenses.

The majority of entrepreneurs (over 61.8%) would welcome the news of Poland joining the eurozone. Interestingly, investment decisions are made independently of EU subsidies, with only one in ten entities considering them to be crucial or significant in this regard.

The biggest threats to businesses in the next year, according to over four-fifths of respondents (81.8%), will be energy and raw material prices, as well as labour costs (67.7%), the general framework of economic policy (53.2%), and demand (52.3%).

Entrepreneurs also believe that the current situation will not only affect current business conditions but also lead to changes in long-term operating methods. Six out of ten respondents identified an increase in supplier diversification as a long-term international change to expect. Moreover, more than half of the respondents expect the cessation or reduction of trade relations in certain regions (57.7%) and an increase in political influence on supply chains (52.3%).

The result of the survey comes as no surprise to me. It’s clear that Poland is on the rise, and investors are taking notice. I have observed this trend in Lublin, which has enjoyed increased interest from foreign investors in recent years, particularly those representing the city’s economic specializations, including business services, biotechnology, machinery and automotive industries. With a skilled workforce, modern infrastructure, excellent quality of life, local government support, and affordable operating costs, Lublin provides everything a business venture could need. This has allowed our city to join the ranks of the most attractive Polish cities to run a business, including being named one of the top business-friendly destinations in Europe for two consecutive years by fDi Intelligence. In 2022, it ranked 9th, and in 2023, it climbed to the 6th spot in the business-friendliness category among cities with a population of 100,000 to 350,000. If you’re looking to invest in Poland and want to take advantage of Lublin’s business-friendly environment, our team from the Lublin’s Investor Relations Office is here to support you in the process, said Igor Niewiadomski, Head of Investor Relations Office.